The M&A process includes all the steps involved in merging or acquiring a company, from start to finish, including: the planning, research, due diligence, closing and execution activities that a company We will share more in this article.

1. What is the M&A process?

The merger and acquisition (M&A) process is a process that includes steps involved in merging or acquiring a company from start to finish, including planning, research, and business valuation, business ends and executes.

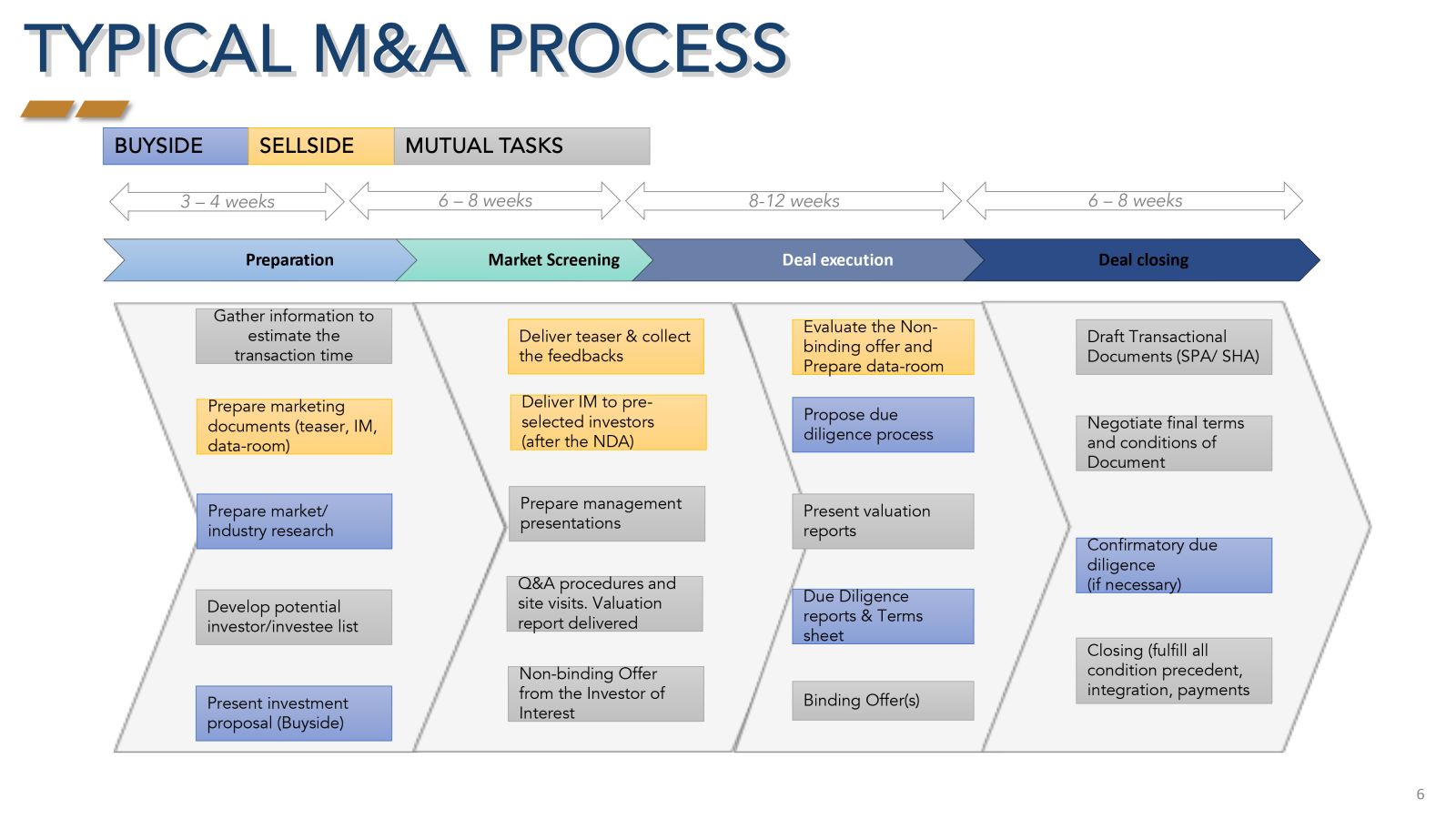

2. M&A implementation process

2.1 Preparation phase

The preparation stage for an M&A transaction plays a decisive role in the success or failure of the M&A deal. For the seller, careful planning and preparation are factors that determine the success of the transaction. For the buyer, this is an extremely important stage. Understanding and evaluating the target audience is key to the official transaction stage of the parties

2.2 Reach target audience

Reaching the target audience can be through many channels such as: Seller’s marketing, self-searching in the information network of the buyer, or through consulting units and brokerage organizations in the same investment field or units specializing in M&A consulting.

At this step, the scope of approach depends on the seller's preliminary assessment of the following factors before deciding to proceed to the next step of the acquisition process:

2.3 Appraisal report

Based on the preliminary assessments in step 1, the buyer will hire professional legal and financial consulting units to evaluate the overall target audience, before making a decision to transact or not.

However, in reality, the seller does not necessarily have to provide all internal information about the business depending on the seller's control regulations, specialized laws or the request of shareholders... Therefore, normally the parties should sign an information confidentiality agreement before the buyer has access to the seller's information data.

In Vietnam, during this stage, depending on the target audience and the buyer's needs, the buyer often evaluates one or both types:

Financial Due Dilligence Report: which focuses on checking compliance with accounting standards, capital transfers, provisioning, loans from organizations and individuals, and the stability of cash flow (taking into account the business cycle), checking asset depreciation and debt recovery ability....

Legal Due Dilligence Report: Focuses on comprehensive and detailed assessment of legal issues related to legal status, capital contribution situation and status of shareholders, legal rights and obligations of the target audience, assets, labor, projects...

Although it is only one step in the whole process of an M&A, the results of detailed appraisal reports play an indispensable role for the buyer, helping the buyer clearly understand the overall issues that need to be faced during the process of acquiring and reorganizing businesses.

3. Negotiation and transaction implementation phase - Signing the M&A contract

3.1 Negotiate and sign M&A contracts

Based on the results of detailed appraisal, the buyer can determine whether the target transaction type is full acquisition or partial acquisition, as a basis for negotiating M&A content. Some issues need noting at this stage are as follows:

Understand the difference between “Merger” and “Acquisition”: Buyers and sellers need to understand the types and variations of M&A transactions to negotiate the contents suitably and effectively. In fact, M&A is always placed side by side but has different natures: With "Merger", the acquired company no longer exists, completely acquired by the seller; Meanwhile, with "Acquisition" the two parties agreed to merge into a new company instead of operating and owning separately. In "Acquisition" itself, there are many very rich variations such as: horizontal mergers, market expansion mergers, product expansion mergers, segmented mergers, mergers and acquisitions, mergers and consolidations. ..

Reasonable pricing: The buyer and seller often cannot meet at the price of the transaction: the M&A paradox often mentioned is that the buyer offers too high a price while the seller only accepts a low price. To solve this problem, parties in M&A transactions often hire an independent valuation unit to determine the value of the buyer.

The contract needs to be complete, transparent, and fully anticipate all situations: The product of this stage is a contract recording the form, price, and content of the M&A deal. If you can get to this step, you can get close to the final stage of M&A. The M&A contract is an expression and recognition of the parties' commitments to the transaction, both mentioning the legal aspect and recognizing the harmonious coordination of other factors related to M&A transactions such as finance, labor, management, market development... The contract also needs to anticipate different cases occurring in and after M&A process as well as handling the consequences. In other words, the M&A contract needs to be designed to become a tool to ensure the rights of the parties involved in the transaction until the post-M&A period.

3.2 Legal procedures for recording M&A

Business mergers and acquisitions are only recognized by law when legal procedures related to recording the transfer from the seller to the buyer have been completed, especially for assets that must be registered with the competent authority. Once this step is completed, an M&A deal can be considered completed.

3.3 Post-M&A phase

The post-M&A phase, also known as the corporate restructuring phase, is a problem for the acquirer about not letting the M&A fail. The buyers' challenges during this period are often personnel instability, changes in management policies, conflicts in corporate culture...

In addition to solving legal and financial issues, although it may have been oriented from the detailed appraisal stage, whether thoroughly resolve existing issues and take advantage of the strength of acquired business or not depends on the ability and experience of the buyer. Often because of the evaluation and appraisal phase, the buyer is often only interested in financial, legal and property issues without fully anticipating issues related to human resources and post-transfer psychology.

|

DAIWA DEVELOPMENT INVESTMENT JOINT STOCK COMPANY Add: Villa 15/2, Hoang Liet Str., Hoang Mai Dist., Hanoi City Tel: +84-24-3668-6390 Email: info@idw.com.vn; info@hbg.com.vn; |

|